At a bank

1. Listen to ten office workers in London ask for services at a bank. What does each person want to do? Complete the notes.

a open an …..account…..

b order a new ……………….

c check his ……………….

d pay a cheque into her ……………….

e send some money ……………….

f deposit money into his ……………….

g pay his electricity ……………….

h buy some ……………….

i arrange an ……………….

j order a new ……………….

Answer & Transcript

b chequebook

c balance

d current account

e ebroad

f savings account

g bill

h traveller’s cheques

i overdraft

j bank card

Transcript

a Hello. I’d like to open an account, please.

b My chequebook’s run out. Can I order a new one, please?

c Can I check my balance, please?

d I’d like to pay this cheque into my current account, please.

e Can I send some money abroad from here?

f I want to deposit this money into my savings account.

g Can I pay my electricity bill here?

h I’d like to buy some traveller’s cheques, please.

i Could I see someone to arrange an overdraft, please?

j I need to order a new bank card. I’ve lost mine

1 … 2 … 3 … 4 …

Answer

1 a 2 j 3 f 4 g

1 Need ID (passport / driving licence),

2 ………………………………….

3 ………………………………….

4 ………………………………….

Answer & Transcript

2 Replacement OK. Need to telephone 24-hr emergency number.

3 Need paying-in slip + bank card. Regular Saver or Bonus Saver account?

4 OK but takes seven working days.

Transcript

1 Yes, of course. I’ll need to see some form of identification, such as your passport, or driving licence … and proof of your address, so a utility bill with your name and address.

2 Oh, dear. Well, I can certainly order a replacement for you here, but you need to telephone our 24-hour emergency number to report it, if you haven’t done that already.

3 Yes, of course. Can I have your paying-in slip and your bank card, too, please? Do you have a Regular Saver or a Bonus Saver account?

4 Yes, you can, but utility bills take seven working days to go through. Is that all right?

Understanding details

1. Raymond, from Hong Kong, is working in Canada and decides to open a savings account. Listen to a bank clerk explain various savings accounts. Tick the account Raymond chooses.

First Reserve ◻

Bonus Saver ◻

Regular Saver ◻

e-Savings ◻

Answer

e-Savings

|

Type of savings account |

Interest rate |

When interest is paid |

Conditions |

|

First Reserve |

2.5% |

annually |

at least $15.000 |

|

Bonus Saver |

3% |

every three months |

20 days’ notice before withdrawal |

|

Regular Saver |

2.3% |

every two months |

no interest paid if withdraw money |

|

e-Savings |

4.5% |

every month |

save at least $100 per month |

Answer & Transcript

|

Type of savings account |

Interest rate |

When interest is paid |

Conditions |

|

First Reserve |

3.5% |

annually |

at least $5,000 |

|

Bonus Saver |

3% |

every three months |

30 days’ notice before withdrawal |

|

Regular Saver |

2.3% |

every month |

no interest paid if withdraw money |

|

e-Savings |

4.1% |

every month |

save at least $75 per month |

Transcript

(Raymond = Chinese; bank clerk = Canadian)

Raymond: I’d like to open a savings account, please.

Bank clerk: Certainly. Which type of savings account do you want?

Raymond: Er, what do you have?

Bank clerk: Well, if you have a lump sum to invest, I’d recommend our First Reserve account. That has an interest rate of 3.5%, paid annually, but you must have a least $5,000.

Raymond: No, I was thinking of saving around $100 a month, actually.

Bank clerk: OK, so our Bonus Saver account might be better. That has an interest rate of 3%. Interest is paid every three months.

Raymond: Can I take the money out if I need it?

Bank clerk: Yes, but you must give 30 days’ notice before you can make a withdrawal.

Raymond: Oh, I see. Actually, I want an account where I can get at the money immediately.

Bank clerk: Then you should have our Regular Saver account. It’s instant access. The rate is 2.3%. Interest is paid monthly, but there’s a penalty if you take money out.

Raymond: What do you mean by ‘penalty’?

Bank clerk: Well, if you withdraw money, then you won’t get any interest for that month.

Raymond: Oh, I see. Do you have an internet savings account?

Bank clerk: Yes, we do. That’s our e-Savings account. The interest rate is 4.1%. It’s paid every month. You have to save at least $75 every month. Our e-Savings account is instant access, too.

Raymond: Does that mean I can get at the money immediately?

Bank clerk: Yes, and there’s no penalty.

Raymond: Maybe I’ll have that one, then.

Bank clerk: You have to apply online for that. We can’t do it here in the branch.

Raymond: OK. Well, thank you very much for your help.

In a post office

1. Listen to eight customers ask for services at a post office. Tick the services they ask for.

pay utility bills ◻

exchange currency ◻

buy car insurance ◻

transfer money ◻

save and invest money ◻

top up your mobile phone ◻

get a personal loan ◻

get a credit card ◻

apply for a driving licence ◻

buy travel insurance ◻

apply for or renew a passport ◻

buy phone cards ◻

redirect post ◻

collect their pension ◻

buy home insurance ◻

Answer & Transcript

a top up your mobile phone

b apply for a driving licence

c pay utility bills

d exchange currency

e redirect post

f collect their pension

g transfer money

h buy phone cards

Transcript

a Can I have a £20 top-up voucher, please?

b Could you send off my application for a driving licence, please? I’ve filled in the form and this is my ID.

c I’d like to pay my electricity bill, thanks. Here it is.

d Could I have £150 in Canadian dollars, please?

e I’m moving house next week. Can you send my mail to my new address?

f I want to collect my pension, please. This is my card.

g Here’s £200. I need to send this to France, please.

h Can I have a £10 phone card, please?

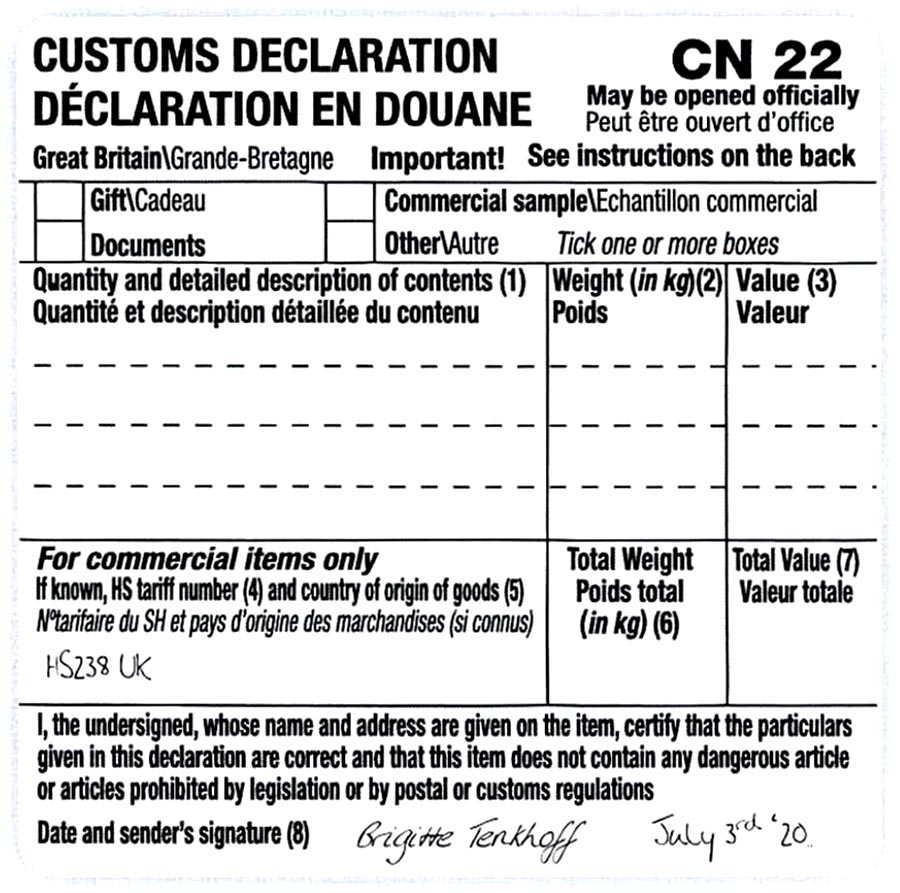

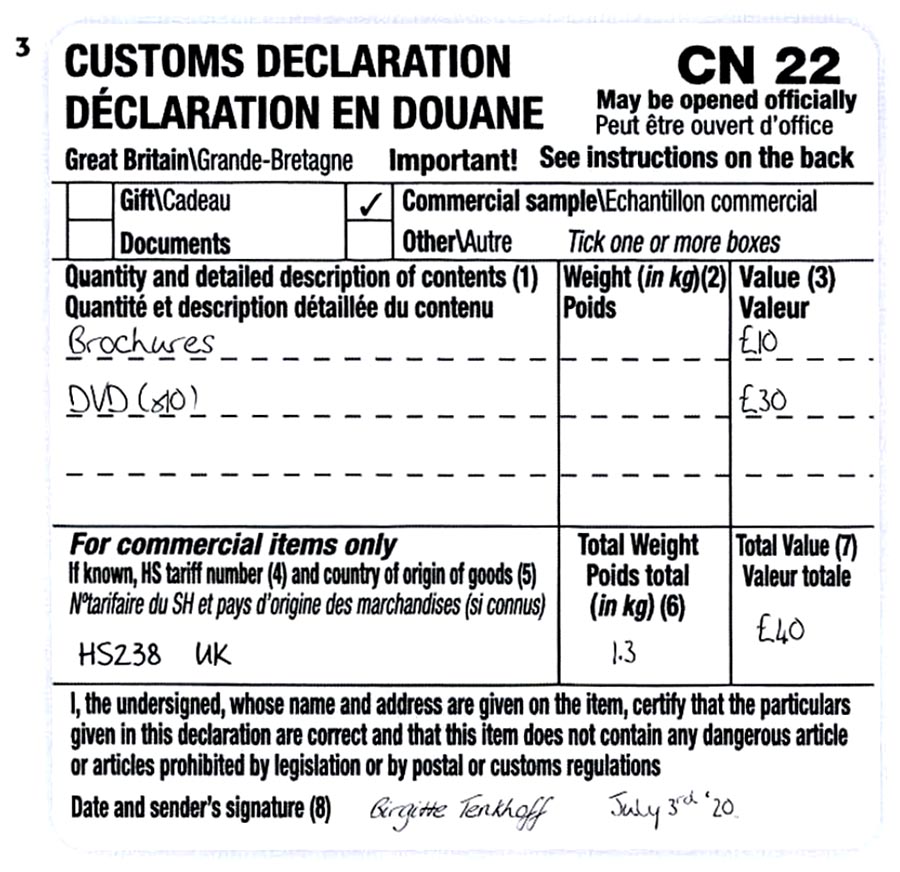

a Where does she want to send the package?

To Switzerland.

b Who is she sending it to?

…………………….

c Why does she have to fill in a Customs label?

…………………….

d What service does she decide to use?

Surface mail ◻ Airmail ◻

International Signed For ◻ Airsure ◻

Answer

b A colleague.

c Because she’s posting the items outside the EU (Switzerland).

d She decides to use the Airsure service

Answer

|

|

Time |

Cost |

|

Surface mail |

a…………………. |

£ b…………………. |

|

Airmail |

c…………………. |

£ d…………………. |

|

International Signed For |

three days |

£ e…………………. |

|

Airsure |

f…………………. |

£ g…………………. |

Answer & Transcript

a two weeks

b £5.28

c three days

d £5.89

e £9.39

f two days

g £10.09

Transcript

Brigitte: Hello. I’d like to send this package to Switzerland.

Clerk: Can you put it on the scales, please? OK, so that’s about 1.3. That’ll be £5.28 by surface mail. It should be there in under two weeks. What’s in it, anyway? A present?

Brigitte: No, some brochures and ten promotional DVDs. It’s for a colleague. How long will it take by airmail?

Clerk: Airmail will take three days. I’ll just check the price … Oh, £5.89. Not much difference.

Brigitte: Oh, well, I’ll send it airmail then. Is it safe? I mean, this is quite important.

Clerk: Well, if you want a signature when it’s delivered, you can send it International Signed For. That’s an extra £3.50, so that’ll be £9.39.

Brigitte: I see.

Clerk: Or, for an extra £4.20, you can send it Airsure. That means priority handling and online tracking for the whole journey. It’s the most secure way to send it, and faster, too. It takes two days. That’ll be £10.09. Switzerland is outside the EU, so you have to fill in a Customs label. Are the total contents less than £270?

Brigitte: Oh, yes. The brochures are, say, £10 and the DVDs cost about £3 each to make, I guess.

Clerk: The fill in this CN22 label and stick it on the top left, can you?

Brigitte: Sorry? Could you say that again?

Clerk: Complete this label and put it on the top left corner.

Brigitte: Oh, right. I’ll send it by the last way you said. The quickest.

Clerk: Airsure? Fine

Related Posts

- Practice Listening English Exercises for B1 – World

- Practice Listening English Exercises for B1 – History

- Practice Listening English Exercises for B1 – Communities

- Practice Listening English Exercises for B1 – Success

- Practice Listening English Exercises for B1 – Emotion

- Practice Listening English Exercises for B1 – Solutions