Exercise 1

A. Listen to It all adds up!, a podcast for consumers on the topic of money. Tick (✓) the topics they speak about.

a How to borrow money for emergency expenses

b Suggestions for reducing living expenses

c Information about how most consumers save

d What will happen to interest rates over the next few months

e News about currency exchange rates

f Tips for changing money when travelling abroad

B. Listen again. Choose the correct option in italics to complete the advice and information from the podcast.

1 It’s a good idea to walk / take your lunch to work.

2 Don’t buy things with your credit card / that you don’t need.

3 Buy a used car / cinema tickets online.

4 In the next few months, interest rates / borrowing will go down.

5 Mortgages / Holidays will become more expensive.

6 Now is a good time to visit China / buy Chinese electronics.

Answer & Audioscript

A

b, d, e

B

1 take your lunch

2 with your credit card

3 cinema tickets

4 borrowing

5 Mortgages

6 buy Chinese electronics

Audioscript

E = Ella D = Dan I1 = Interviewee 1

I2 = Interviewee 2 I3 = Interviewee 3

I4 = Interviewee 4 I5 = Interviewee 5

I5 = Interviewee 6

E: Hello, listeners, and welcome to It all adds up!, the programme that talks about money. I’m your host, Ella Leeson. Today we’re going to start with more tips for saving money. Dan Parks went into the street to talk to people and get ideas for saving money on living expenses. Dan?

D: Thanks, Ella. I went to London’s Oxford Street earlier this week and asked people how they spend less and save more. Here’s what they said.

I1: Make your own food, so you don’t spend money on lunch.. If you take your lunch to work, you will save hundreds a year.

I2: I don’t have a car now – I sold it! You will save thousands – and become healthier – if you cycle to work instead of driving.

I3: Stop using your credit card. Pay it off. Only spend money you already have – don’t borrow it.

I4: Save money every month for emergencies. Then, when you have a problem with your house, or you need a new car, the money will be ready.

I5: Don’t buy a new car. If you buy a car that’s just one year old instead of a new one, you will save a lot of money.

I6: Go to the cinema on a discount day. My local cinema is cheaper on Mondays. There are special prices online.

D: Smart people out there in Oxford Street, Ella.

E: You’re right. Lots of great ideas for spending less and saving more.

D: Right – a little bit here, a little bit there. It all adds up!

E: It all adds up! So, Dan, what can consumers expect in the next few months?

D: Well, the first thing we’re looking at is a possible small increase in interest rates.

E: But that’s not official yet, is it?

D: No, the government hasn’t confirmed it, but it looks very likely.

E: What will that mean for consumers?

D: If interest rates increase, borrowing will go down. People borrow more when loans are cheaper.

E: So if people are thinking of borrowing … ?

D: They should do it now, before interest rates go up.

E: OK. Anything else?

D: Housing costs will go up – people who own a home will pay a little more each month.

E: So, not great news.

D: No, but it is good news for people with savings. If banks raise the interest rate on savings, savers will earn more. That means it’s a great time to start saving, or to increase saving.

E: It all adds up!

D: It all adds up, Ella!

E: Anything else?

D: Just one more thing before I go. International exchange rates. We’re watching China closely, because its economy is really strong at the moment. Electronics imports here will be more expensive if China’s currency becomes stronger.

E: OK, so if you’re thinking of getting a new TV …

D: … now may be the time. We’ll probably start to see prices go up in a couple of months.

E: Thanks, Dan. Some great tips!

D: Thank you, Ella.

E: That’s it on money saving for this show, but now we’re going to move on to …

Exercise 2

A. Liz is a Marketing Consultant to the retail banking industry. Listen to the first part of her presentation to a group of clients and answer the questions.

1 How does Liz get the attention of her audience at the start?

2 Which three generations does she talk about in her introduction? Complete the information in slide 1.

|

1 Customer age groups |

|

|

Generation (b. 1964-79) |

………………… |

|

Generation (b. 1980-94) |

………………… |

|

Generation (b. 1995-2012) |

………………… |

3 Which generation is the main subject of her presentation? Why?

4 How do the audience describe this generation in terms of:

• lifestyle? • technology? • work? • money?

B. Liz used the approximate words early, mid and late to talk about ages and dates. Can you remember the phrases she used for the following? Listen and check.

1 17–19-year-olds …late teens…

2 21–23-year-olds ……………………

3 1964–6 ……………………

4 1977–9 ……………………

5 1981–3 ……………………

6 2011–13 ……………………

Answer & Audioscript

A

1 She asks the audience a simple yes/no question, asks them to raise their hands if the answer is yes and makes a little joke – all good ways of getting their attention.

2 Generation X (b. 1964-79), Generation Y (= Millennials) (b. 1980-1994), Generation Z (b. 1995 2012)

3 Generation Z because they are already over a quarter of the population and will soon be the bank’s biggest customers.

4 lifestyle – live for today (perhaps don’t plan for the future); technology – always online (perhaps not much face-to-face contact); work – don’t like to work (perhaps more interested in leisure activities); money – no idea about money (perhaps spend more than they save)

B

1 late teens

2 early twenties

3 mid-nineteen-sixties

4 late seventies

5 early eighties

6 early twenty-tens

Audioscript

L = Liz M1 = Male 1 F1 = Female 1 M2 = Male 2 F2 = Female 2

L: Good morning! Could I just ask you to raise your hand if you have children in their late teens or early twenties? You’re probably the ones with the largest debts. Hm, quite a lot of you. And that’s not really surprising because, like me, you’re the right age. Most of us in this room belong to what we call Generation X – the generation born somewhere between the mid-nineteen-sixties and the late seventies. Of course, the younger ones among us, born between the early eighties and the mid-nineties, are Generation Y, also known as the Millennials. You still have teenage kids to look forward to! And it’s teenagers and young adults that I’m here to talk about today. Born between the mid-nineties and the early twenty-tens, we call them Generation Z. They are already about a quarter of the total population and they will soon be our biggest customers. Now, when I say Generation Z, what words and phrases can you think of to describe them? Anybody? Yeah … ?

M1: Live for today!

L: Uh-huh.

F1: Always online.

L: Right.

M2: Don’t want to work!

F2: No idea about money!

L: Oh, dear. We’re getting a bit negative, aren’t we? Well, I think some of the research I’m going to share with you this morning may just surprise you.

Exercise 3

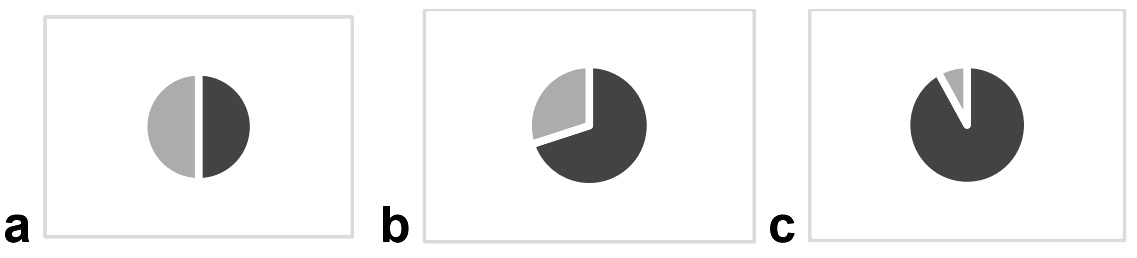

A. Listen to Liz present the financial habits of young adults with approximate figures. What are the exact figures? Use the exact figures below and write them on slide 2.

12 21 29 64 76

|

2 Financial habits (16–21-year-olds) |

|

|

• paid employment |

..76..% |

|

• own savings account |

……..% |

|

• account-holders since age |

……..% |

|

• already saving for retirement |

……..% |

|

• opposed to all forms of debt |

……..% |

B. Listen again and answer the questions.

1 What do the employment figures for 16–21-year-olds show?

2 What does Liz say is the most surprising figure in the chart? Why?

3 What kind of debt are 16–21-year-olds against? Why?

4 What’s the good news about 16–21-year-olds for the retail banking industry? What’s the bad news?

Answer & Audioscript

A

paid employment: 76%

own savings account: 64%

account-holders since age 10: 21%

already saving for retirement: 12%

opposed to all forms of debt: 29%

B

1 The employment figures for Generation Z, which are almost the same as for the older Generation Y, prove that they are not afraid of work.

2 The most surprising figure is that 12% of Generation Z is already saving for their retirement, even though most of them will not retire for fifty years or more.

3 They are especially against college debt, which has been a major problem for Generations X and Y in the USA.

4 The good news for banks is that 16–21 year olds like to save money. The bad news is that they don’t like to borrow it.

Audioscript

Now, just a moment ago some of you suggested that Generation Z ‘lives for today’, ‘doesn’t want to work’ and ‘has no idea about money’. So let’s see if that’s true. Have a look at this chart, which shows the results of our survey of the financial habits of people aged sixteen to twenty-one. As you can see, roughly three-quarters of them are already earning their own money through some kind of full- or part-time employment. To put that in context, that’s almost the same as the figure for Generation Y. So that shows Generation Z is certainly not afraid of work! You can also see that nearly two-thirds of them have their own savings account. In fact, around one in five has had one since the age of ten. But perhaps the most surprising thing is that over one in ten of them are already saving for retirement! A retirement which may be over fifty years away! Another interesting thing is that just under three out of every ten are strongly against any kind of debt – especially, college debt. Let’s not forget that college debt is currently over one and a half trillion dollars in this country and has been a major financial problem for Generations X and Y. The key takeaway here is that Generation Z likes to save, but doesn’t like to borrow. Obviously, that’s good news for those of you running savings accounts. But maybe not such good news for those of you working in the loans department!

Exercise 4

A. Listen to the final part of the presentation. What do the figures in slide 3 show?

|

3 Marketing to young savers |

|

10.6 1bn 53% 42m

|

1 10.6 = ……………………

2 1 billion = ……………………

3 53% = ……………………

4 42 million = ……………………

B. What does Liz say about her client’s marketing strategy?

Answer & Audioscript

A

1 10.6 = the average number of hours each member of Generation Z spends online per day

2 1 billion = the total number of hours Generation Z in the USA spends online per day

3 53% = the percentage of Generation Z who say they prefer face-to-face communication to online communication

4 42 million = the total number of Generation Z who say they prefer face-to-face communication to online communication

B

Liz points out that, because more than half of Generation Z prefer face-to-face communication, the bank needs to connect with them on a personal level. This means doing more than just social media marketing.

Audioscript

So, how do we market personal banking services to Generation Z? Well, you were right about one thing. Generation Zers are ‘always online’. On average, they are currently spending over ten and a half hours a day working or playing with digital content. To give you an idea of just how much that is, multiply it by the total number of Generation Zers in the USA, and it comes to around a billion hours of online activity every day! That’s enough time to watch every movie ever made – one thousand times! But here’s the really surprising thing. Our studies show that more than half of Generation Z say they actually prefer face-to-face communication. That’s over forty million people who want to talk to us in person! So, in summary, if we want to attract this new generation of customers, we need to make sure we connect with them on a personal level. And, in terms of selling banking services, this clearly means that we need to be doing a lot more than just social media marketing.

Exercise 5

A. Read the town councillor’s notes for the meeting. Then listen and complete them.

Topic: Practical ideas and real solutions.

1 Advertise to attract …………………………

2 Create a local …………………………

3 Set up a ………………………… bank

4 Start an online goods ………………………… – on social media?

5 Start a Saturday ………………………… in the town centre

B. Match the ideas (a–e) with the descriptions (1–5) in Exercise A. Listen again and check your answers.

a Develop a type of money that’s only for our town

b Make it easy for people to trade things they don’t need for things they need

c Arrange a place in town for local people to sell things

d Invite people from other places to visit our town – and spend money

e Get people to share their skills by trading hours of work

C. Now listen to the end of the meeting. Which ideas does the town vote to consider more seriously?

Answer & Audioscript

A

1 (more) tourists 2 currency 3 time

4 exchange (marketplace) 5 market

B

1 d 2 a 3 e 4 b 5 c

C

local currency, time bank, Saturday market

Audioscript

A

Welcome, everyone. We’re really happy to see so many people here, so much interest in making our town a better place. The purpose of today’s meeting is to discuss practical ideas and real solutions. We’ve had discussions with quite a few of you already, and there are five main ideas we’d like to discuss today. So I’ll introduce the ideas, and then after that, we’ll have about ten minutes to discuss each of them.

So, here we go. The first idea is to get more tourists here. We would hire an advertising agency and advertise nationally or internationally about our great town. Tourists would come and spend money here.

Two. Create a local currency. Towns and cities all over the world have done this. It doesn’t replace our national currency – it’s money you can spend in local businesses. This encourages people to shop here in town.

Three. A time bank. In a time bank, anyone can offer their skills – a doctor, a car mechanic, a cleaner. If you work for someone for two hours, then you get credit for it, and you can ask someone to work for you for two hours.

Four. An online exchange – probably on social media – for second-hand goods. There are a few marketplaces that people use online, but we could have our own, just for people in this area, and people could trade things for other things.

Five. Start a Saturday market for local goods in the town centre. This could be vegetables, things you make at home, possibly second-hand items. We could do this every Saturday, or maybe once a month. So, those are the main ideas to discuss today. Now we’ll take about ten minutes for each idea, and after that we’ll vote and choose three that we think are the ones that are the best …

C

OK, so now we’ve counted the vote, and we’ve decided to consider the following three options more seriously. First, we’ll look at creating a local currency. Second, we’ll see about setting up a time bank. Finally, we’ll consider the idea of a Saturday market in town. Thanks a lot, everyone. We’ll contact you all by email before the next meeting.

Exercise 6

A. Listen to local residents Ellen and David discussing the projects. Which project does Ellen like the best? Which one does David like the best?

B. Listen again. Who expressed each opinion? Write E (Ellen), D (David) or N (neither).

1 Local currency

a It’s interesting – good for business.

b It’s weird – lots of people think this.

c It’s old-fashioned – we don’t need it.

2 Saturday market

a It would help to create jobs – people will make things to sell.

b It’s easy to understand – people will go to see other people.

c It’s not interesting – you can sell stuff online.

3 Time bank

a I’m too busy to use it.

b I’d rather just pay people.

c It’s a good way to meet people.

Answer & Audioscript

A

Ellen: Saturday market

David: local currency

B

1

a D b E c N

2

a N b E c D

3

a E b D c N

Audioscript

E = Ellen D = David

E: So, what do you think of the proposed projects?

D: They’re interesting ideas.

E: Yeah. Will you vote?

D: Sure, yeah. But I haven’t decided yet – I think they could all be useful. The local currency idea is definitely interesting. It would be good for local business.

E: Do you think? It seems kind of a strange idea to me – kind of weird – and I know other people who think it’s strange, too. But maybe we’re just old-fashioned.

D: You may have a point there!

E: I like the sound of the Saturday market. That’s just a good, honest idea that everyone can understand. People will see it as a social event.

D: Yeah, maybe. But I think it’s a bit boring compared to the other two. I mean – it’s easy to sell old stuff, right? Why not just sell it online? Don’t you think the time bank could be good? I mean, you’re an accountant. If you join a time bank, people will definitely want your services.

E: Maybe that’s what scares me! I have a job – I’m too busy for extra work.

D: I’m with you. I’m the same. I’m not sure I want to trade any of my skills. Sometimes it’s easier just to pay people.

E: Yeah, definitely.

D: I think if we create a local currency, local businesses will definitely get a boost.

E: Maybe – but I’m not so sure.

D: Well, I think that one’s going to get my vote.

Test

1. Listen to the speakers and choose the polite way to say no a, b or c.

1 a b c

2 a b c

3 a b c

4 a b c

5 a b c

Answer & Audioscript

1 c 2 a 3 c 4 a 5 b

Audioscript

1 Perhaps you could set up the computer?

a Ask someone else.

b No, it’s too difficult.

c I’m not very good at IT.

2 Could you do the PowerPoint for us again?

a I’d prefer not to do it again.

b I’m not doing it again.

c If that’s ok with you.

3 I’d like you to design the offices.

a Sorry, if that’s OK.

b Sorry, but it’s fine by me.

c Sorry, but I’d rather not be the designer.

4 I was thinking you could write the report.

a I’m not as good as Susie at writing.

b No, I’m not doing it.

c My writing is very bad.

5 How would you feel about going to the meeting alone?

a I don’t want to go to the meeting.

b If I have a choice, I’d prefer not to go.

c Sorry, I’ll say no.

2. You will hear eight short recordings twice. For questions 1–8 choose the correct answer.

1 What does the woman spend most of her income on?

2 How does the man pay at the hotel?

a by credit card

b by mobile phone payment

c in cash

3 How is the man going to save more money?

a walk to work every day

b take his lunch to work

c rent a room in his home

4 Why does the woman like paying by credit card?

a She doesn’t need different currency.

b It’s light to carry when travelling.

c She doesn’t need receipts.

5 What does the man think he is best at in his job?

a public speaking

b working with numbers

c managing his time

6 How much have the company’s sales increased over the year?

a about 10 percent

b nearly a quarter

c roughly a third

7 Who is going to be the lead presenter?

a Francisco

b Luis

c Gaston

8 How was the budget for the project divided?

Answer & Audioscript

1 c 2 c 3 b 4 a 5 a 6 b 7 b 8 b

Audioscript

1 What does the woman spend most of her income on?

A: Do you try and save a lot of your income?

B: No, I’m not very good at saving.

A: Really? But you bought your house.

B: Well, my parents paid for most of that. I don’t know where my money goes. I don’t go on expensive holidays or anything. Most of it probably goes on clothes. A new coat one week … shoes the next … it all adds up!

2 How does the man pay at the hotel?

A: Are you checking out, sir?

B: Yes, please.

A: That will be a hundred and sixty-eight for the two nights. How would you like to pay?

B: Do you take phone payments?

A: We don’t I’m afraid. We can take cash, cards or cheques.

B: I think I might have it in cash … Yes, here. Can you give me a receipt? I’ll need to claim it back, you see.

A: Of course, sir.

3 How is the man going to save more money?

I really need to save more money. I try to budget every month, but I usually only have a few pounds left to save. It’s so expensive living here! I have already stopped taking the tube to work, I walk now. I suppose if I start taking lunch from home, I’ll save more. The only other option is to rent my spare room out and I’m not doing that! I love living alone.

4 Why does the woman like paying by credit card?

A: You are always travelling for work. How do you pay for things?

B: I normally put it all on my work credit card.

A: So, no need to keep all those receipts then …

B: Oh no, I still have to keep the receipts. But I’ve got to say it’s useful when you travel to other countries.

A: Why’s that?

B: Well, I don’t have to worry about having lots of different coins. That can be so confusing!

5 What does the man think he is best at in his job?

A: Do you like everything about your job, Mark?

B: Yes, I do. I really love working with numbers but I don’t think I’m very good at it.

A: What part of your job do you think you do best?

B: Public speaking is probably what I’m strongest at. I am quite good at managing my time but I still need to improve this area.

6 How much have the company’s sales increased over the year?

The sales figures for the last year are in and I can tell you that we’re doing well, but not as well as we wanted. We haven’t quite reached our target of a 33% increase, but we are nearly there. The actual increase is 24.6%. This is a better figure than all other years, so there is only a 10% difference in what we predicted. Hopefully we can make this up with some changes to our marketing strategy.

7 Who is going to be the lead presenter?

So, we need to decide on what we are going to do for the presentation next week. It’s important that we get this right. Francisco, I want you to write the presentation, but I want Luis to deliver it. I think he’s our best public speaker. Gaston, can you look at the numbers and add them to the presentation? I want this all finalised by Friday if we can.

8 How was the budget for the project divided?

B: The project is nearly finished now. Did we stick to our budget, Alan?

A: Yes. Things are looking quite good. We’ve stayed on budget well. As we expected, we spent just over a quarter of the budget on marketing and the rest was spent on development costs. And we are also more than two thousand pounds under budget!

B: Excellent news, Alan.

3. Listen to a radio discussion about spending habits. For each question choose a, b or c.

1 How have people’s spending habits changed in the last five years?

a People spend more.

b People save more.

c People spend money on different things.

2 What has risen most in price?

a taxes

b housing

c food

3 What suggestion does Lena make for saving money on restaurant food?

a Use more vouchers.

b Go and eat at different times.

c Eat more takeaways.

4 What does Lena think about buying new technology?

a People buy new things too often.

b It often isn’t worth the money.

c Most website offers are bad.

5 What advice does Lena give for buying a new smartphone?

a Buy them with a contract.

b Don’t buy one with a brand name.

c Buy an older model.

6 According to Lena, which is the best way to pay when you are overseas?

a cash

b prepaid card

c credit card

7 According to Lena, where is the worst place to exchange currency?

a at an airport

b at a hotel

c online

Answer & Audioscript

1 a 2 c 3 b 4 a 5 b 6 b 7 a

Audioscript

Listen to a radio discussion about spending habits.

P: Lena Mayer, our economics editor, is here today to tell us about how people are spending their money at the moment. So, Lena, are we all generally still spending the same as we did, say, five years ago?

L: Well, we’re not really spending our money any differently, but things are more expensive right now, so we need to spend more, and we are saving less.

P: And why has this happened?

L: Well, everyday essentials cost more, and this is what we usually spend our money on.

P: What kind of things? Like transport or housing costs?

L: No. More basic things like the cost of a loaf of bread. Maybe a three-cent rise seems small, but it all adds up.

P: So, if small things are more expensive, how can we save?

L: People are still spending money on luxuries, and I think there are some really great savings to be made in that area.

P: OK, can you give us some examples?

L: Let’s look at eating out. It’s so popular, and people tend to do this at least twice a month. But there are some ways to do this more cheaply. We know that people use meal vouchers, but you can only use these in some restaurants.

P: That’s true.

L: My advice is, if you can go out to eat during the day, you’ll get cheaper food! There are some fantastic lunch deals. Dinner is always much more expensive. The cost of takeaways is also very high for what you get, so try and cut back on them, too.

P: I agree! A pizza in my local takeaway is over twenty dollars!

L: And let’s remember that the ingredients probably cost about three dollars!

P: Are there any other ways we can save?

L: There are. Think about technology. Almost everyone has a smartphone and a tablet. Maybe even more than one, and every year many people buy the latest model. This costs us a lot of money! Of course, the latest technology is great, but do we need a new tablet or phone every year?

P: But if we all want the newest models, what can you do?

L: My advice is shop clever. Look at smartphones. If you search on websites, you can find better deals on the same kind of product without the brand name. So, your new phone might not say Samsung or Apple, but if it does the same thing for two hundred dollars less, you’re winning!

P: Some great advice there, Lena. Some of our listeners have sent us a few questions about saving. Here’s one, from Travis. He wants to know the best way to save on spending money when you’re abroad.

L: Well, firstly, do not use your bank cards to take money out of an ATM. If you do this, you’re sure to have a lot of extra bank charges. What I recommend is taking a prepaid travel card. You can buy these online. If you put money on it, it will change it into the currency you’re going to use. The rates aren’t often as good as exchanging the currency in cash, but they are much safer.

P: That’s a good idea.

L: You could also exchange currency before you leave and take it in cash, but obviously if you lose your cash or it’s stolen, you’re in trouble. Consider keeping some in the hotel room safe. Also, don’t exchange your money at the airport as the exchange rates are terrible. It’s much better to be organised and buy currency online if you decide to take cash …

Related Posts

- Practice Listening Business English Exercises for A2 – Personal development and training

- Practice Listening Business English Exercises for A2 – Managing time

- Practice Listening Business English Exercises for A2 – Future trends

- Practice Listening Business English Exercises for A2 – Performance

- Practice Listening Business English Exercises for A2 – Corporate hospitality

- Practice Listening Business English Exercises for A2 – Environmental protection